Separating Planning and Portfolio Advice

DFS Portfolio Solutions Principal, Stephen Romic, addresses the future of Financial Advice, which is based on his firm’s experience in successfully separating planning and portfolio advice. The DFS approach promotes advisor accountability through transparency and offers an objective framework that enables consumers to consistently measure the levels of value and success they are achieving.

DFS Portfolio Solutions Principal, Stephen Romic, addresses the future of Financial Advice, which is based his firm’s experience in successfully separating planning and portfolio advice. The DFS approach promotes advisor accountability through transparency and offers an objective framework that enables consumers to consistently measure the levels of value and success they are achieving.

The Royal Commission has the financial services industry on edge. Both large institutions and small are sitting up and paying attention as they have never before. Big changes are afoot; probably the biggest ever. Industry opinion is calling for a ban on conflicted remuneration grandfathered under FoFA. Eyebrows are being raised at the revenue models of advisors that run virtual portfolio services and perhaps the service providers that support such enterprises. Advisory firms that receive brokerage, in addition to portfolio management fees and advice fees may be feeling nervous, if not vulnerable. And this could be just the tip of the iceberg. The Royal Commission appears to be pointing to reform to directly address the embedded sources of conflict.

How did we get here?

The industry advice model typically bundles planning advice fees and portfolio advice fees. It is the unintended consequence of policy responses to past dysfunctional behaviour relating to product sales promoted by large financial institutions. Despite several rounds of policy and legislation, there has been insufficient recognition of and differentiation between planning advice and portfolio (product) advice, which has continued to promote a product-oriented culture within the industry. The large institutions, as the largest stakeholders and proponents of industry self-regulation have been largely responsible for developing today’s advice model under this flawed framework. The “institutional advice model” has facilitated a culture of unabated product sales, which has long been the lifeblood of the advice industry.

It is well known that the major institutions actively developed product manufacturing capabilities to build investment products and subsequently investment platform technology as distribution channels for their high margin investment products. By incorporating platforms as an integral operational component within advisor business models, it secured the wholesale support of advisors under the guise of “technology”. These significant distribution capabilities have enabled institutions to actively market investment products (many of which are in-house products) to their captive customers as well as external advisor networks that are compelled to operate within the system.

In truth, it’s the way business is done and how the advice market essentially operates. While the vast majority of advisors conduct themselves with their clients’ best interests in mind, the advice system largely straightjackets them. There is no objective framework that enables advisors to consistently account for the value they are providing. They are essentially being gamed by the house; and as we all know, the house always wins. The product-oriented advice model has long been understood by many service providers who have actively subscribed to the adage “if you can’t beat them, join them.”

Where does this leave investor best interests?

Divided opinion

How to best serve clients’ interests is now the subject of growing interest and speculation. The old guard is sticking to its guns and arguing that a ban on grandfathered revenue will unfairly result in excessive profits flowing to the institutional product manufacturers and further create a large body of severely underserviced consumers. This sounds a little like moved cheese[1]. Some suggest that sales titles should be imposed on those who deal in product advice; and that the designations of financial planner and/or financial advisor should be restricted to those that receive no remuneration for product advice. Others yet are calling for preferred tax treatment on fees charged by advisors that do not receive any remuneration for product advice. In general, we believe a more inclusive response to reform is preferred to such restrictive approaches.

Accountability through Transparency

Bundling planning advice and product advice is the source of the embedded conflict that has distorted the advice industry for so long; we all know this and so does the Royal Commission. Separating product fees from advice fees is the first step to addressing the underlying conflict. It imposes transparency upon the system, which is key to sustaining consumer best interests. It allows consumers to better understand what service they are receiving; and to confidently benchmark and compare their services (and costs) with other readily available options in the market. Providing accountability through transparency is in large, the only way advisors can sustain a successful long-term relationship with their clients.

The current advice model clearly must change.

Where to from here?

While consumer demand for unbundled service fee arrangements has been subdued to date, the Royal Commission has identified the issue as an embedded conflict. Consumer awareness is now on the rise. Fee unbundling may indeed be forced upon advisors and it may occur sooner rather than later.

To future-proof their businesses, we believe the advice industry must take three meaningful steps to address the embedded conflict and save itself well before the Royal Commission submits its recommendations. It must:

1. separate planning advice fees and product advice fees

2. benchmark planning advice fees

3. benchmark portfolio performance

Benchmarking Planning Advice Fees

The foundation of our proposed planning advice framework is the adoption of client service infrastructure to support the various elements required to deliver and price planning advice. Clearly, this should be linked to time expended by respective staff members for services provided. Advisors would be free to set their charge out rates, in line with the practice of other professions.

The planning advice fees would then be subjected to an industry “reasonable test” which would be compared to the broad categories of: (1) simple advice; (2) intermediate advice; and (3) complex advice. That is, each advice category should be subject to regulation and supported by service definitions and pricing guidelines.

To illustrate, let’s assume a consumer with intermediate planning advice requirements was being charged $2,500 over a 12 month service period. The advisor would have an obligation to benchmark her fees against the regulatory guide for intermediate advice of say $1,500pa-$4,000pa. In this case, the benchmarking informs the consumer that he is at the lower range of the price guide. However, if the planning advice fees was $6,500 and the services provided were largely captured in the intermediate service definition, then it would be incumbent on the advisor to substantiate the basis on which her fees are appropriate. The framework would also cater for reductions in the cost of planning advice as strategies are progressively bedded down by advisors. Servicing activity for consumers that require complex advice may morph and fall under the intermediate service advice definitions and perhaps to simple advice, over time. Such levels of accountability would otherwise be unachievable without a transparent fee structure.

Portfolio Performance Benchmarking

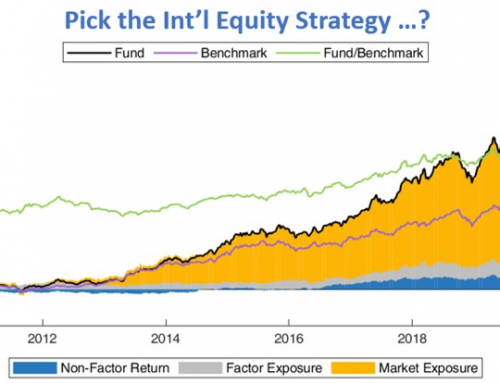

Having separated and appropriately accounted for planning advice fees, advisors are now in a position to assess the value of their portfolio advice service. Portfolio returns, net of all investment related expenses can now be compared against specified industry benchmarks based on five (5) standardised risk profiles and disclosed to clients. Advisors would be required to account for portfolio underperformance against the specified industry benchmarks and substantiate the basis on which the portfolio service continues to be in the clients’ best interest. On a rolling 3 year basis, any underperformance against the specified industry benchmarks would require additional disclosure in the form of providing opportunity cost projections. For example, if an “advised” portfolio of $500,000 generated 5%pa over 3 years against 6.5%pa for its relevant benchmark, the 20 year opportunity would be $236,000 in today’s value (or 29%) assuming a consistent level of underperformance. Clients would be in a strong position to make informed decisions and work with the advisor to decide on whether to stay the course or seek other portfolio options.

The Final Requirement

The unbundling of advice signals that each service can be separated at the consumer’s discretion. That is, they can choose to switch their portfolio service to another provider whilst maintaining the planning advice service with their current advisor, or vice versa. Such freedom around service mobility further expedites the transition to consumer best interests. Importantly, it would require the support of consumer protection laws that give consumers the option to terminate each service, seamlessly and cost free as their discretion.

Consider Exceeding Regulatory Expectations

Our proposed framework would quickly change the culture of the advice industry and lead to significant improvements in the way advisors account for the advice they provide. Advisors who wish to stay ahead of the regulatory curve may choose to go further and incorporate risk-benchmarking services.

How would risk-benchmarking work?

Let’s take a portfolio that adopts a strategic asset allocation (SAA) approach and is implemented entirely through passive investments. Such portfolios are attractively priced and can be accessed at a total cost of around 0.6% to 0.7%pa. A strong feature of SAA portfolios is their relatively high and permanent exposure to equity risk, which explains their strong performance under stable market conditions. However, what if the consumer is highly sensitive to capital drawdowns and is not open to calls to “ride out the storm” when markets turn down significantly?

A robust risk benchmarking framework would address the above trade-off between fees and value. Indeed, cheaper investment management fees do not necessarily mean better performance. Nor are higher fee portfolios necessarily better quality. As highlighted in our paper “Of Super Importance”, simple risk frameworks can be applied to measure net portfolio returns relative to the risks taken and compared to the standardised Risk Profile Indexes, which adjust for risk.

Clients’ best interests are not just about fees; they are only one part of the bigger picture that includes investment risk and returns, risk preferences and also the quality of services provided by advisors.

The biggest Challenge for Advisors

Transitioning to an advice model that incorporates regular portfolio benchmarking is likely to problematic for many advisory firms. Most firms are price takers and effectively pay retail rates on platform fees, which places them at an immediate disadvantage. Additionally, most advisory firms construct their portfolios from retail approved product lists, which tend to over-represent active managers; and this further adds to portfolio management costs. Lastly, advisory firms are increasingly mobilising to managed account structures and are building investment committees to oversee their investment decisions, which comes at a cost. Therefore, advisory firms will generally struggle to compete against recognised industry benchmarks due to significant fee drags. Most advisors apply strategic asset allocation approaches, as do the large retail and industry super funds; however, advisory firms are often forced to pay twice the cost. It effectively becomes a futile attempt to peg back their large fee handicaps.

Such significant challenges may encourage advisory firms to take tactical asset allocation approaches in attempt to add value over strategic asset allocation portfolios. However tactical asset allocation is dependent on accurate and timely return forecasts, which is easier said than done. Inaccurate forecasts amplify or reduce risk at the wrong time. Others yet may opt for direct equities and/or ETFs to reduce fees. However, while such responses may reduce costs they may also introduce other challenges. For example, direct equity portfolios can be highly concentrated and insufficiently diversified and be heavily exposed when markets turn.

What does it mean in the end?

Irrespective of the investment path chosen, regular performance and fee benchmarking will inform consumers of what value and success they are achieving. Advisors with insufficient portfolio management skills will be at a distinct disadvantage and unlikely to maintain their portfolio service offering. The industry will see a growing number of advisors that will specialise in planning advice and outsource the investment management responsibility.

The proposed framework will ultimately lead to a re-distribution of fees from a large part of the advice industry to the hands of consumers and innovative firms that successfully respond and account to higher standards. No doubt, such a framework will see great changes in the industry and no doubt sow the seeds of a new profession.

Having made the decision to separate planning advice fees from portfolio advice fees in 2009, almost 10 years prior to the Royal Commission, DFS developed a service offering that enables investors and advisors to discern what value they are achieving by benchmarking their fees, portfolio returns and portfolio risk levels. Our framework is being successfully delivered to clients, today.

References:

[1] “Who Moved My Cheese?” is a well-known motivational business fable published on 8 September 1998.

Disclaimer