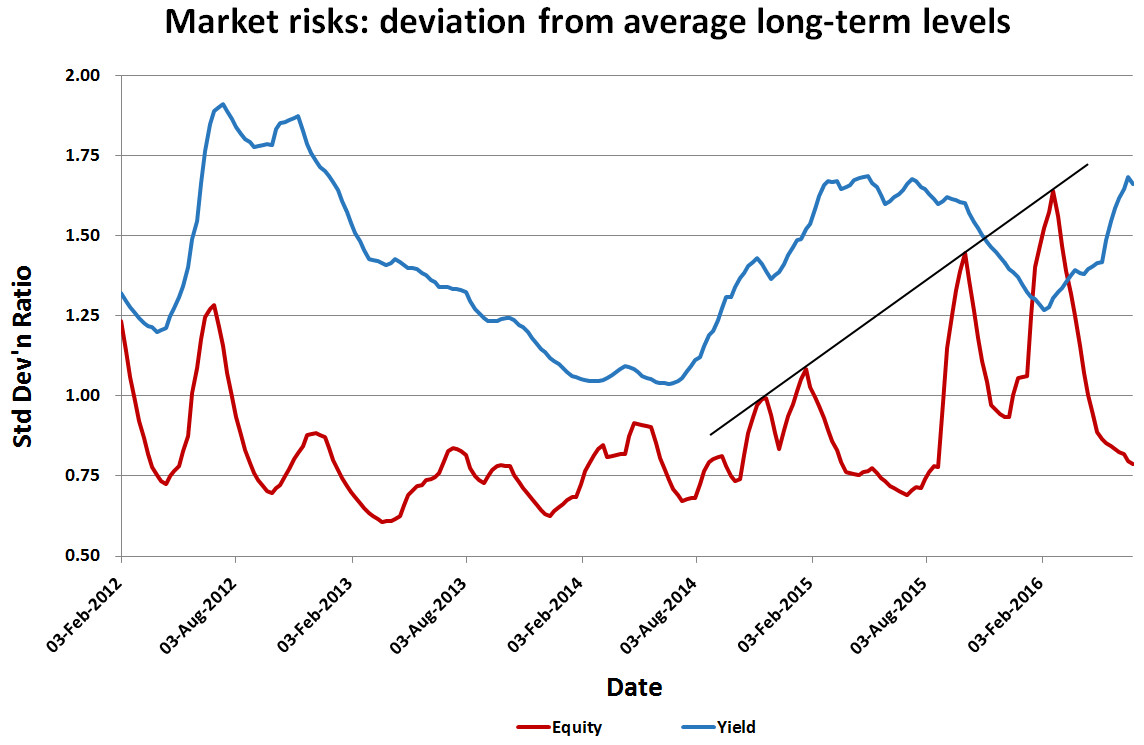

With the cash rate now at an all-time low (1.5% pa), the prospect of anaemic global economic growth, and growth assets inflating considerably over the last several years, future returns are likely to be meaningfully lower compared to the past. Additionally, prevailing macroeconomic and geopolitical risks are likely to increase market volatility. Indeed, we have seen equity-risk and yield-risk levels increase over the last 2 years as highlighted in the chart below.

The above chart shows that equity-risk had been stable (~25% lower than the average long-term level) between August 2012 to September 2014. Since then, there have been several spikes in equity-risk and we question (notwithstanding its recent decline) whether the current upward trend is likely to continue. Similarly, we observe a significant increase in yield-risk since mid-2014; it is now around 70% above its average long-term level.

Our analysis suggests that the underlying income yields of diversified portfolios have compressed to an average level of around 3.5%p.a., before adviser, platform and fund manager fees. This means investors will have to rely more on capital growth to achieve their required rate of return. With higher levels of portfolio risk creeping into conventionally managed portfolios, it will be interesting to see how ‘rational investors’ respond to an environment of lower returns and higher risk…?

Financial advisers that adopt a strategic asset allocation (SAA) approach will need to moderate their clients’ overall risk/return expectations. However, this position might need to be re-assessed when portfolios experience low (or negative) capital growth for any protracted period. In such conditions, the strong and permanent equity-risk bias within SAA portfolios is likely to be a major cause of angst among investors.

Directly investing in hybrids and fully franked shares to reduce investment management costs and ‘chasing yield’ to reduce the dependency on capital growth have been popular responses to yield compression. While they have worked in the past, the last 12 months or so has shown that it is far from a certain bet. Investors often hold highly concentrated positions and have been exposed to much greater levels of volatility than they otherwise had to. Indeed, the sustainability of shares with high pay-out ratios is increasingly being scrutinised as are the unintended consequences of increased risk-taking as investors continue to chase yield.

Passive investing has been another common response to reduce investment management costs. Ironically, beta exposures tend to do well in buoyant market conditions (against relative value or active managers) but are prone to under-performance and likely to be fully exposed to capital draw-downs in volatile conditions.

Investors have a general preference to reduce uncertainty at the best of times and their behavioural biases will no doubt be put to the test in what is becoming an increasingly uncertain world. We continue to favour a risk-based approach to stabilise portfolio risk; where multiple levers are applied to achieve risk-diversification and where both active and passive managers are used as integral components of the dynamic asset allocation process.

Investment management has never been more challenging! Asset allocation approaches that reduce rather than increase uncertainty are likely to be rewarded and achieve better portfolio outcomes over the next decade.