The question for many investors is whether to hold their portfolios or to de-risk by selling into the recent rally.

It would be reasonable to hold or to add to portfolio risk if you believe that the virus will be contained quickly and the unprecedented monetary and fiscal stimulus will be effective in addressing the economic drag. It would also be rationale to de-risk if you believe that short term containment of Covid19 is unlikely, which suggests that the stimulus is likely to be less effective.

No one really knows which scenario will truly play out, which explains why markets are so jittery.

Ultimately, it comes back our individual risk aversion level so we need to ask ourselves whether the lament we’d feel from further falls would be less or greater than the utility we’d receive from capturing upside returns. The answer to this behavioural question prompts us to reflect on how we would feel under two hindsight scenarios. It effectively helps us to reinforce our true risk profiles and reassess how our financial objectives may be impacted. Having done so, we next question whether previous volatility spikes tell us anything about the potential direction of markets from this point.

Capital Market History

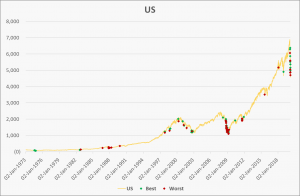

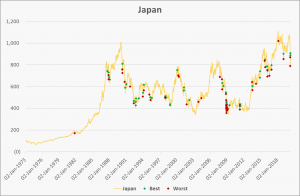

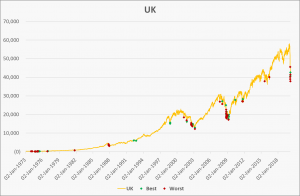

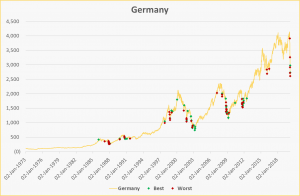

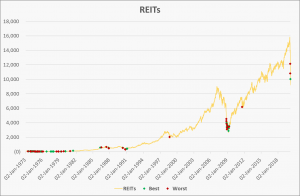

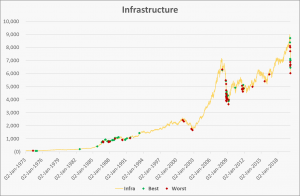

The following charts plot the accumulated returns of multiple equity markets and show that the timing of the (50) best & worst daily returns generally occur when markets are volatile. The charts further highlight that the worst days often follow after experiencing the best days.

The recent rally

We need to be careful in reading too much into the “current rally, which saw the S&P500 increase by 17.6% before falling 3.4% on Friday . While the sharp rise is welcome, it’s unsurprising that the market bounced back strongly, given the level of stimulus announced. It highlights that:

- we are in a highly volatile period

- volatility occurs in clusters, meaning the worst and best days tightly band together

- markets are highly sensitive to good & bad news and reactions are amplified on both sides

We further note that while we observed a large number of best and worst daily returns during the GFC, equity markets didn’t start to recover until we saw a concentrated cluster of worst days. We have yet to observe such a concentration in the current bear market. It may not necessarily play out this way, however given that Covid19 could stifle economic growth for some time, it’s certainly not unreasonable to expect more best and worst days to follow from here.

To de-risk or to hold is a difficult decision in the face of so much uncertainty. Any sell-down should not be considered lightly given the current market weakness. Those considering de-risking should only do so if their portfolios do not reflect their current risk profile. Even so, assistance should be sought from their financial adviser.

Good luck and good health to us all.

Disclaimer