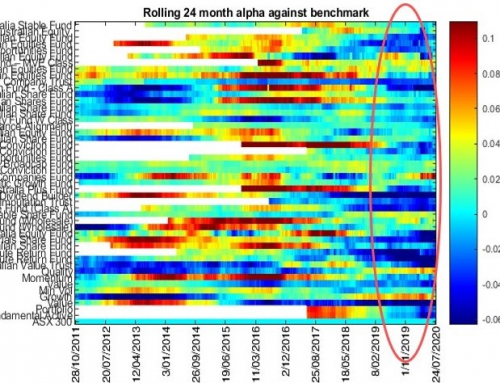

The charts show the average non-factor returns (commonly referred to as idiosyncratic returns or alpha) generated by our short-listed Australian and international equity strategies. The monitoring of non-factor returns across active strategies is important, as it shows the extent to which decisions made by active managers are being rewarded.

Searching For The Better Alpha Generators

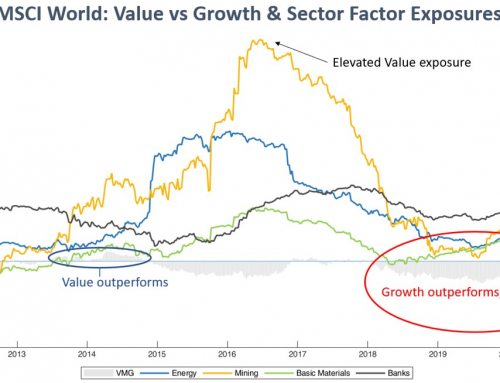

The short-lists are made up of around 40 strategies for each sector, being the product of our recent Australian and international equity sector reviews. Each short-listed strategy generated notable levels of risk-adjusted returns with varying degrees of consistency and would loosely be regarded as investment grade products of many approved product lists. We decompose the returns of each strategy to identify how much of the total return is made up of market-beta versus factor betas (Value, Growth, Momentum, Size etc) and finally, non-factor alpha. It is a systematic enhancement we recently introduced that allows us to better account for each strategy’s return drivers. The charts plot the average alpha generated by each short-list over rolling 2 years, which indicates changes in the opportunity set for actor strategies.

The analysis highlights that short-lists generated meaningful value in spite of having periods of nil or negative alpha. For Australian equities, the average alpha generation has been negative since early 2017. However, it was strongly positive over the previous 7 year period. Conversely, the international equity list generated negative alpha from October 2009 to October 2012, but produced significant non-factor alpha, thereafter. Overall, the analysis supports the case for active management.

A case for increasing the Active Budget

Non-factor returns are uncorrelated to market returns and therefore are legitimate portfolio diversifiers. Such benefits are amplified under muted market returns and/or under volatile conditions. We are currently exposed to such conditions, with real potential for volatility to be much greater over the next decade compared to the last. If so, increasing the active budget makes sense as it reduces reliance on market returns and diversifies portfolios.

That said, the biggest risk for advisors implementing active strategies is paying too much for beta while receiving insufficient and inconsistent alpha. In our plight, over 100 strategies in each sector review were screened out; around 40 were short-listed; and ultimately 10-odd were reserve-listed. The better managed strategies are out there, but need to keep searching, far and wide.

Disclaimer