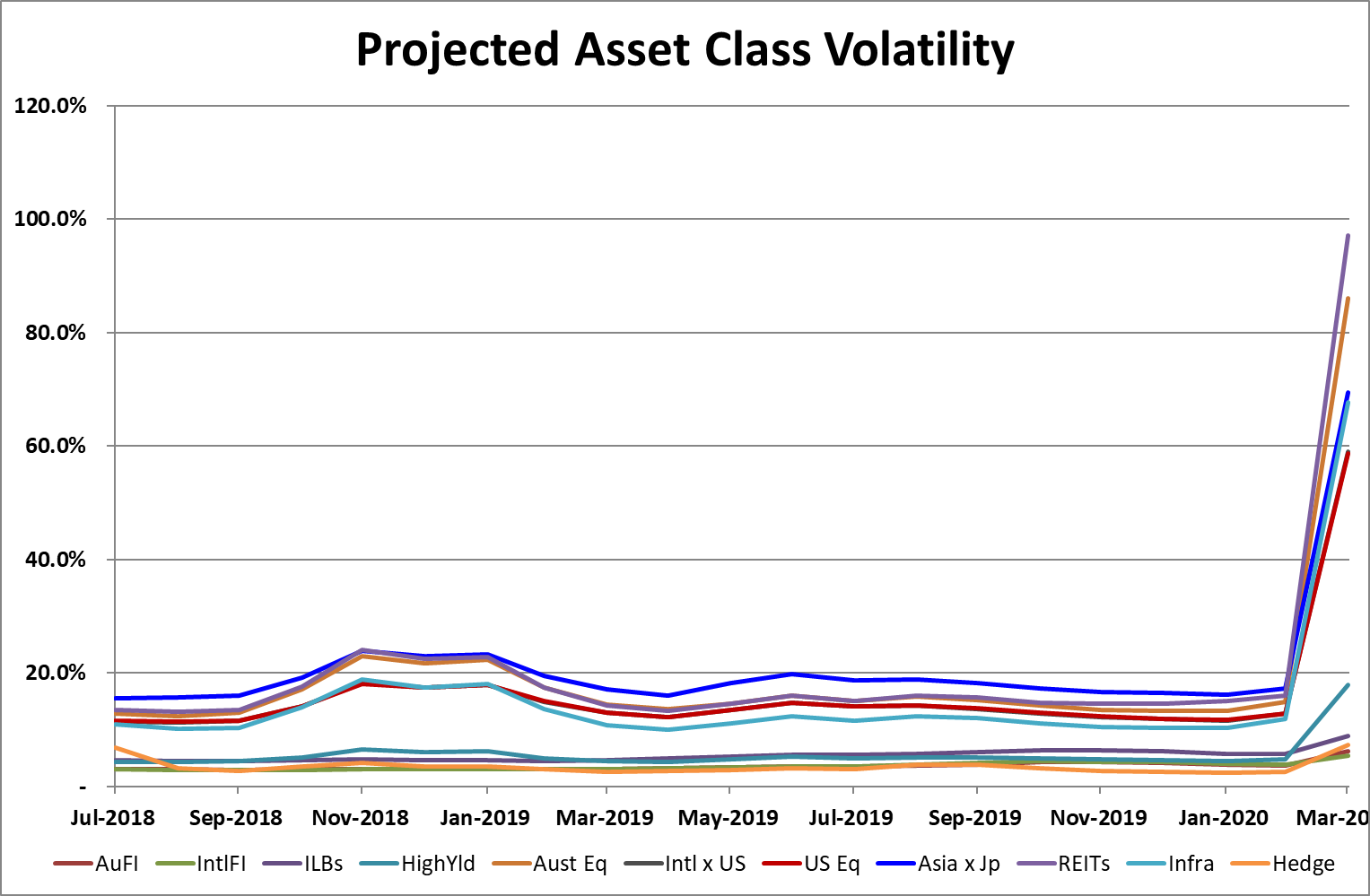

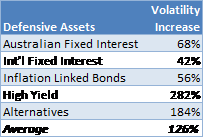

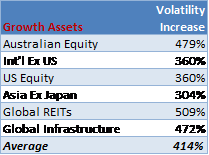

Each month, we monitor the risk levels of each sector we invest in, with the recent spike being nothing short of overwhelming. Risk spiked by an average of 414% across our spectrum of Growth assets and by 126% across our Defensive assets. The tables below show the change in volatility for each sector over the month to 31 March 2020:

For Defensive assets: fixed interest investments (AFI, IFI & ILBs) were the most stable with an volatility increasing by an average of 59%. For our Alternatives strategies, the 184% volatility increase was off a low base of 2.6% to finish up at 7.4%. High Yield was unsurprisingly exposed to the highest spike, given it has significant embedded equity risk.

For Growth assets: global REITs and Infrastructure were the most turbulent, with Australian Equity close behind. International equities were were less volatile (in AUD terms), with Asia Ex-Japan surprisingly ending the month with the lowest volatility.

We are certainly in a very volatile period, which includes the current rally. While it is certainly welcome, we need to to be careful not to read too much into it. It’s certainly unsurprising that the market would bounce back strongly in response to the unprecedented stimulus; and particularly after selling-off so quickly. It effectively shows that:

- we are in a very volatile period;

- volatility clusters, meaning the worst and best days tightly band together;

- markets are highly sensitive to good & bad news and reactions are amplified on both sides.

Disclaimer