The popularity of Dynamic Asset Allocation continues to grow under expectations that they will generate better portfolio outcomes for investors. However, many dynamic asset allocation approaches have significant limitations and risks.

Most dynamic asset allocation approaches apply (uncertain) market forecasts to position their portfolios and are generally implemented through ETFs and/or direct equities. When such forecasts diverge from ensuing market conditions, there are few tools available; the position is either maintained or the forecast re-set and exposed to further uncertainty. Similarly, passive investments do a good job in capturing the upside during strongly performing markets, but offer inadequate diversification when markets turn. Lastly, direct equity portfolios have been sustained over many years by the stellar performance of the largest 50 Australian shares. However, large-cap shares have recently come under pressure and many direct equity portfolios are now buckling.

The risk-based approach of DFS Portfolio Solutions has many more tools at its disposal. Firstly, the objective behind our dynamic asset allocation approach is to better manage portfolio risk. We do not engage in return forecasts to drive asset allocation decisions; we side-step the guesswork. Instead, we stabilise risk levels by re-balancing portfolios when meaningful changes in market risks are actually observed. Protection from capital losses during volatile equity markets is further incorporated through additional equity risk-management overlays.

Secondly, our portfolios allocate to liquid Alternative Investment Strategies. These strategies significantly reduce portfolio risk as (unlike traditional assets) they are not meaningfully exposed to market risk factors. The table below shows that the DFS Alternatives Model has performed well against cash and against equity markets during draw-down periods. The strong diversification benefits have continued through to November 2015, with the Alternatives Model posting an estimated return of 1.6% while equities finished down between 1% and 2%.

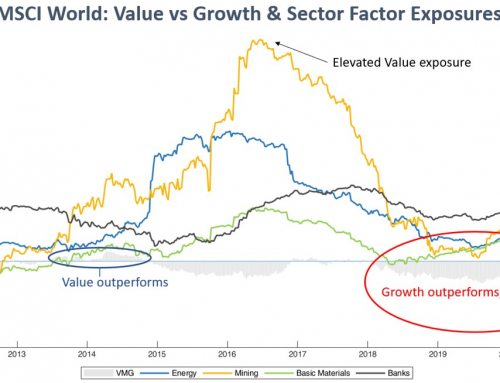

Thirdly, alternate portfolio tools are applied when different market conditions are encountered. Under stable market conditions (when active managers generally struggle to keep up), portfolios are tilted to growth assets through low cost passive investments to efficiently capture the strong returns. When markets turn, portfolios are rotated away from passive investments to active managers (which, while relatively more expensive) are well positioned to do the heavy lifting required.

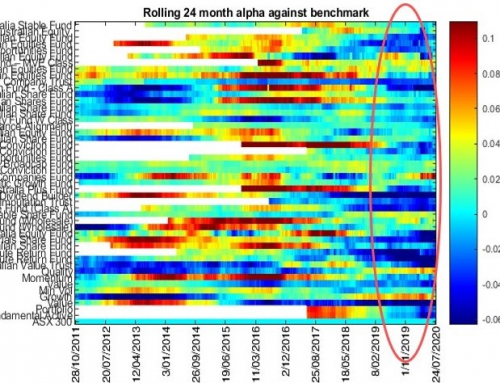

Lastly, the DFS Australian Equities Model for is exposed to highly specialised active managers to enhance the risks-adjusted performance. While perhaps less fashionable than direct equity portfolios, the well diversified Australian Equities Model has added significant value during the recent sell-off and over the longer term as shown below:

The Australian Equity Model feeds into the Risk Profile Models, which are governed by our risk-based dynamic asset allocation process. The table below shows that the Models have out-performed their respective Morningstar benchmarks (which are theoretical, nil fee portfolios made up of composite indices) for virtually all 12 month periods and beyond. The Models have reacted to the recent equity market sell-off and have substantially rotated away from risk assets in favour of defensive assets. While the rotation resulted in marginal under-performance against the Morningstar benchmarks over the last 3 to 6 months, capital drawdowns were successfully checked. The Risk Profile Models are now skewed to active managers and over-weight defensive investments. They are well-positioned to perform well under riskier market conditions.

Our risk-based dynamic asset allocation approach has multiple tools at its disposal to better manager portfolio risk. Portfolios respond to stabilise risk levels by re-balancing as meaningful changes in market risks are observed. An additional equity risk-management overlay is triggered during volatile equity markets to protect portfolios from capital losses. Both passive and active managers are applied as integral tools to the portfolio construction process. Portfolios are skewed to passive strategies under stable market conditions and to active strategies under more volatile market conditions. In preference to direct equities, we gain exposure to Australian equities through highly specialised active managers to improve the risk-adjusted performance, net of fees. Finally, greater levels of portfolio diversification are achieved by blending traditional assets (cash, bonds & equities) with strategies that are not exposed to market risk factors.

Rigorous risk-based processes with multiple portfolio construction tools provide significant enhancements to any dynamic asset allocation approach. Ultimately, this leads to improved portfolio outcomes, which is central to the needs of investors.

Disclaimer : This DFSPS document is a general guide publication and does not constitute and is not intended to be a substitute for professional financial advice. In preparing this document, we did not take into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. You should not rely nor act on any information contained in this article without seeking professional financial advice. Past performance should not be taken as a guarantee for future performance.