Request Your Fee Appraisal

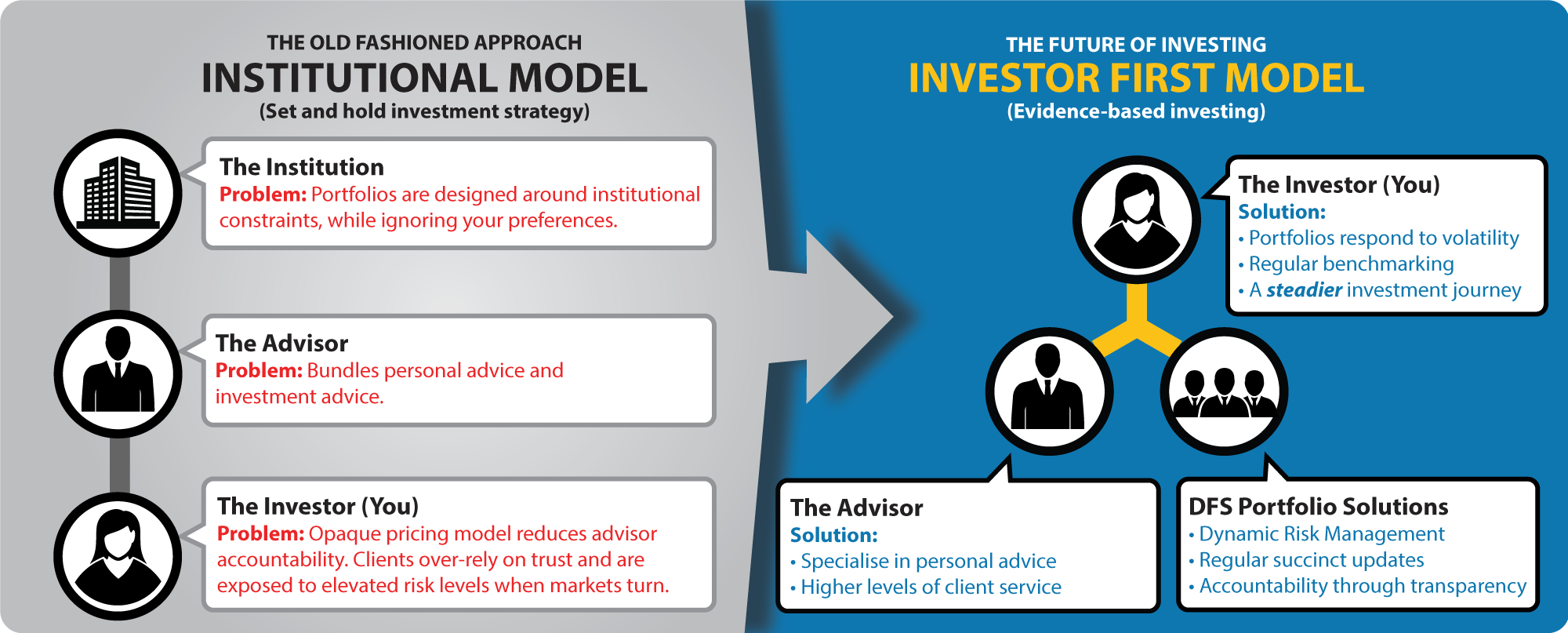

Designed for investors. Not institutions.

Separating personal advice from portfolio advice may seem trivial, but it’s one of the most important aspects to consider when choosing an advisor. To properly benchmark your portfolio performance, you need to separate planning advice fees from portfolio advice fees and compare them against professional standards. The DFS approach promotes advisor accountability through transparency and offers an objective framework that enables consumers to consistently measure the levels of value and success they are achieving.

The Royal Commission has opened up a Pandora’s Box for the financial services sector. While the industry scrambles to change, investors have been left with little option but to wait it out and accept the status quo. In short, the industry model largely takes a cookie-cutter approach, which bundles personal advice with investment product advice. It’s the source of the embedded conflict, leaving investors with insufficient means to hold advisors to account. There is a better option.

DFS subscribes to an evidence-based approach that elevates the investor by providing high levels of accountability through transparency. Separating personal advice fees from investment related fees allows you to compare your fees and returns on an apples-to-apples basis. Ask us how we can help you separate fees, to create more transparency and accountability from your advisor.