Further to our recent post on Sector Valuations which looked at the current & historical CAPE leveIs of MSCI equity sectors, the following publication takes a closer look at the their key return drivers.

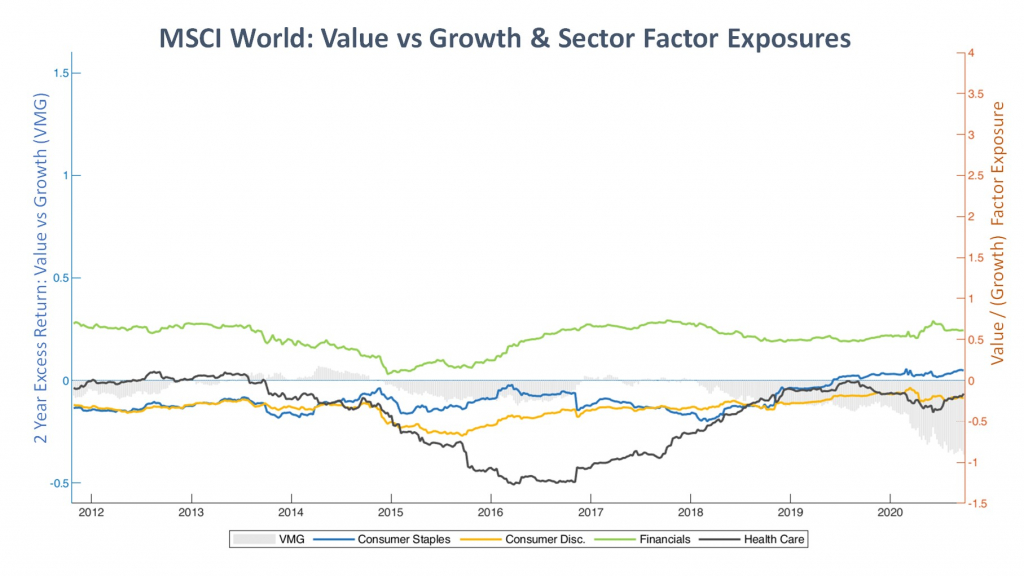

The feature chart’s primary y-axis shows the rolling 2-year excess returns of Value stocks versus Growth stocks (grey shaded area) since 2009. Apart from the period between 2013 and 2015, Growth has been the clear out-performer. The maximum 2-year out-performance of Value against Growth stocks was 7.2%, which occurred over the course of 2014. In contrast, Growth outperformed Value stocks by 30.8% over the most recent 2 year period; and by 46.2% since 2009 !

The feature chart’s secondary y-axis shows the extent to which equity sectors have been exposed to the Value factor (denoted by positive values) & Growth factors (denoted by negative values), over time. We see that Basic Materials, Mining, Energy & Bank sectors have shown persistent exposure to the Value factor, which at times has been highly elevated (Energy: 2015-2017; Mining: 2016), albeit largely unrewarded.

The following two charts highlight that Consumer Discretionary and particularly Health Care & Technology have had meaningful exposure to the Growth factor, which has underpinned their strong performance over the last decade. Indeed, these sectors out-performed the MSCI World Index by an average of around 53%, since 2009. Each of the remaining sectors failed to keep up with the benchmark; and on average under-performed by around 38%.

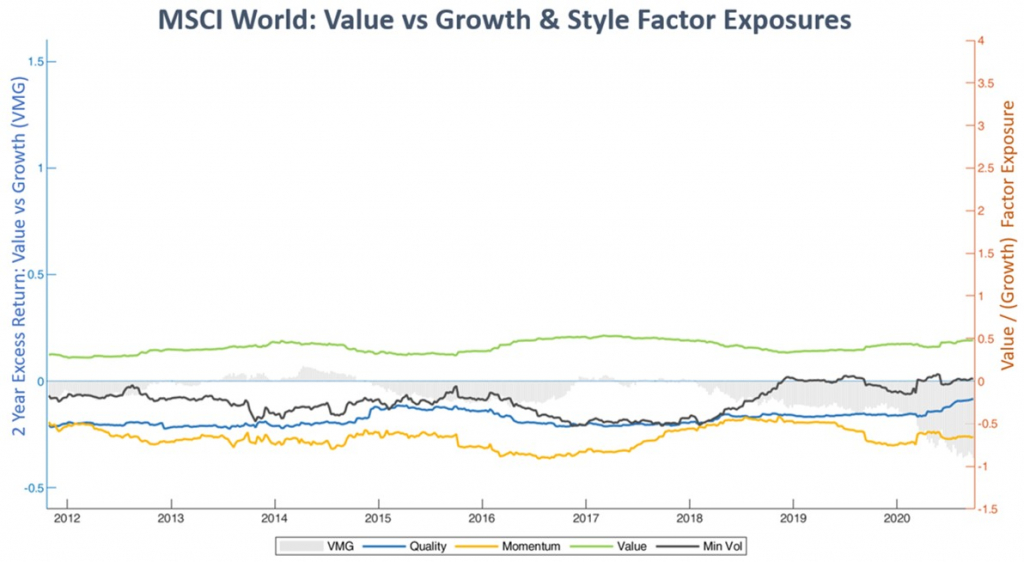

The last chart shows the factor biases of each major investment style, with Momentum & Quality showing strong exposure to the Growth factor.

Implications

The above suggests that Momentum is likely to be hit hardest in the event of rotation from Growth to Value stocks, followed by Quality. From a portfolio exposure perspective, while sector diversity hasn’t paid off in recent years, it seems sensible from hereon. There’s significant embedded ‘value’ in multiple sectors, as highlighted above.

It might be a good time to check the basis of your current portfolio positioning.