Australian Equity Models: Managing Risk & Return Outcomes

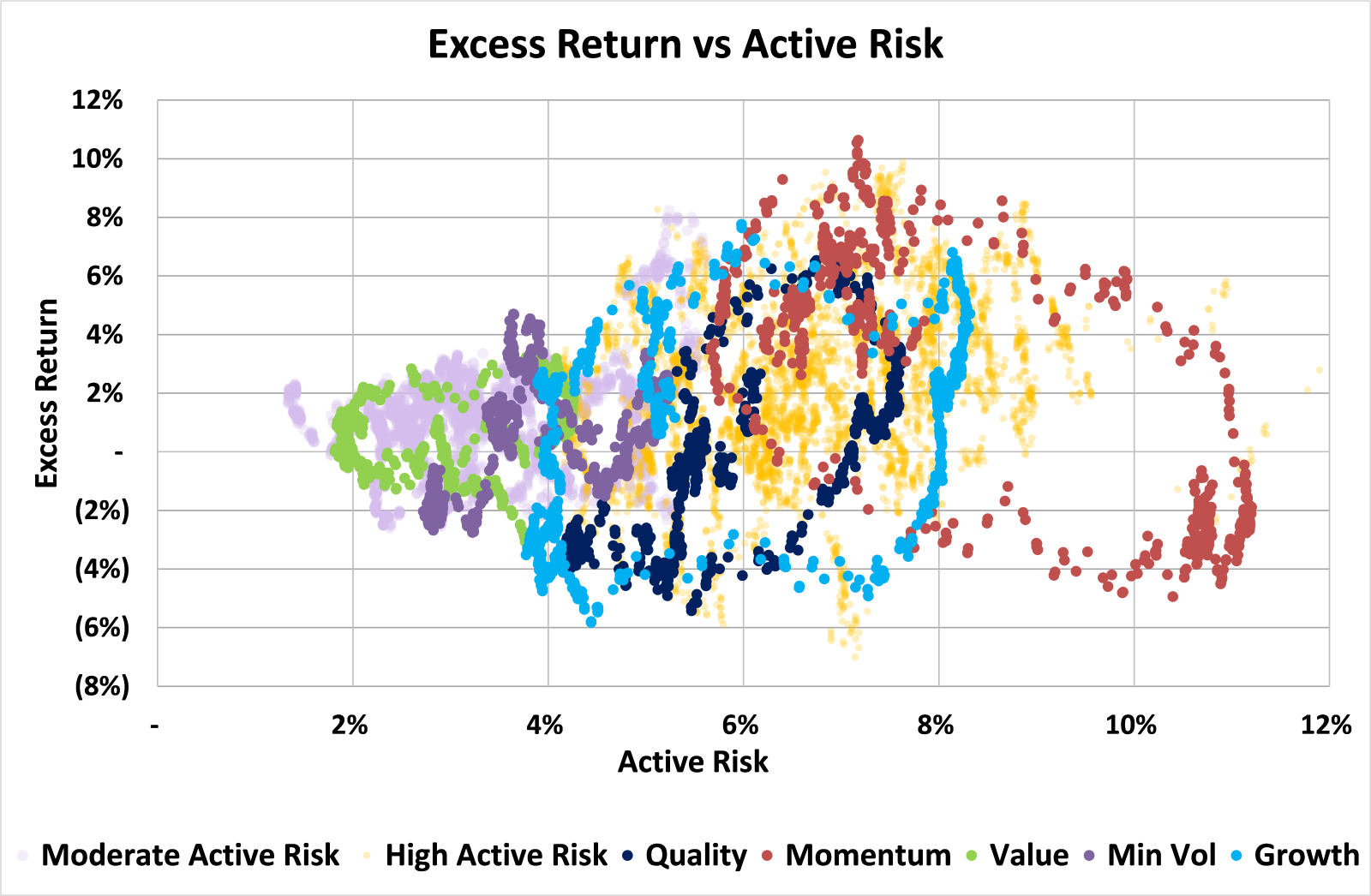

The chart looks at the risk & return outcomes of factor based strategies and our short-list of fundamental strategies, which we have further partitioned into Moderate Active Risk & High Active Risk strategies. The analysis is based on rolling 5 year data and provides a good guide of what we can expect from the major factor-based strategies and their fundamental counterparts. The analysis highlights that return outcomes are far from certain. Unsurprisingly, as active risk increases, the greater the potential for both outperformance and underperformance.

We see meaningful risk-return dispersion in each of the factor-based strategies. Value has assumed the lowest level of active risk and its excess returns have been more tightly compressed. In contrast, the Momentum factor has assumed the highest risk and experienced the greatest return dispersion. The remaining factors lie somewhere in between. The dispersion across the fundamental strategies are notable, with active risk ranging between 1.5% to 12%.

Portfolio Construction Implications

The analysis is a useful starting point to frame our portfolio construction considerations. Wealth managers need to be cognisant of the resulting active risk levels when combining strategies; and appreciate the potential dispersion in return outcomes. Combining too many strategies could dilute active risk levels and inadvertently produce an expensive enhanced indexed fund. Moreover, blending similar strategies may lead to insufficient diversification and ultimately too much active risk.

While systematic strategies provide wealth managers with additional investment selection options, pivoting away from product oriented approaches is likely to be rewarded. Active risk targeting and separating market returns from factor based and idiosyncratic returns introduces a more granular and robust approach to portfolio construction. It provides greater transparency and insight into the risk and return drivers at the blended portfolio level; and allows wealth managers to better monitor and manage the risks they wish to target and mitigate those they wish to avoid.

If such an approach strikes a chord or if you wish to investigate further, please feel free to drop us a line.

Disclaimer