A year that most Active equity strategies want to forget

If you thought 2018 was a bad year for active strategies, just check out the results of our 2019 screen of broad based Australian equity strategies.

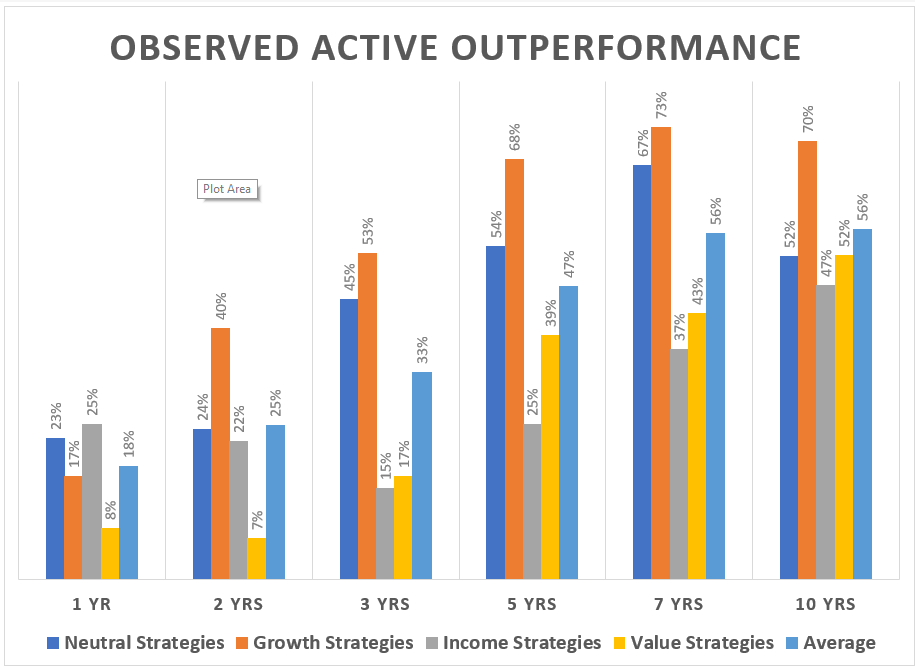

Only 18% of active strategies outperformed the benchmark over the last 12 months. Value oriented strategies fared the worst. However, as we go back over time we see a meaningful proportion of active strategies outperforming the benchmark, with Growth oriented strategies dominating.

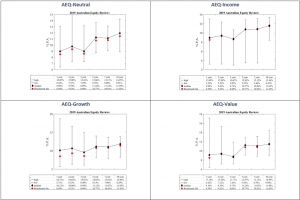

The chart below shows the dispersion of returns within each category against the median and benchmark returns. Notwithstanding the lack of traction in recent years, the charts suggest that active strategies can be beneficial to portfolios over the longer term.

Low beta & insufficient alpha

In recent years, most active strategies have taken on much less market risk (beta) compared to index funds, which has been costly under buoyant market conditions. Moreover, most active strategies have not been able to generate sufficient idiosyncratic returns (alpha) to compensate for their lower beta exposures. This largely explains the general under-performance of active strategies.

Defaulting to Passive is sensible

A passive investing approach is a sensible default as it optimises returns under normal or buoyant market conditions, which occur some 75%-80% of the time. Many active managers are likely to outperform under bearish conditions only because their beta exposures are much lower; however, such out-performance is likely to be insufficient to peg back the under-performance during buoyant conditions.

Short-list

Passive approaches are likely to serve you well, unless your investment selection process is able to identify and implement strategies that are likely to generate superior returns. Such processes can be rewarding; however they need to be robust, granular and frequently reviewed. Our 2019/2020 Review has short-listed 10% of active Australian equity strategies, which are now subject to further analysis. I intend to share the general attributes of the short-listed strategies in the new year, which will highlight why they are markedly different to the 90% and worthy of further investigation.

Until then… wishing you all a Merry Christmas and a Happy New Year !

Disclaimer