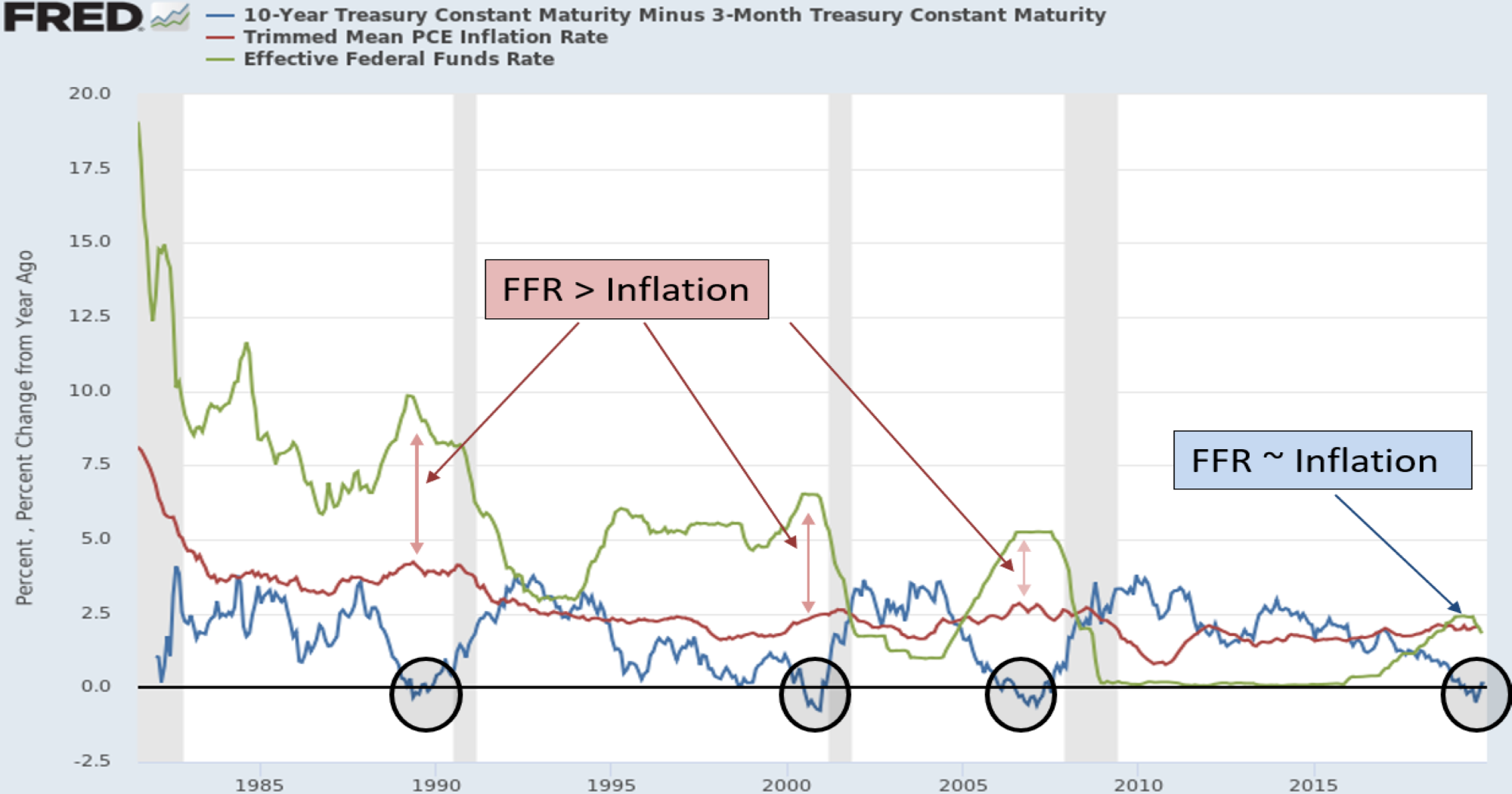

Further to our recent post, titled: Yield Curve Inversion: Time for Prudence, the chart below looks at the US cash rate during past inversions against the recent 2019 inversion:

The chart shows that while US cash rates substantially exceeded inflation leading up to prior inversions, it has been more or less on par with inflation this year as the yield curve inverted. This indicates that monetary policy is less restrictive this time around compared to conditions leading to past inversions and may offer a plausible reason for a more sanguine economic outlook.

Could it be different this time ?

The argument has some merit, but it’s difficult to make firm conclusions from a single occurrence. Certainly, the cash rate today is less restrictive, but the question then is what has been driving down the long end of the yield curve. With QE unwinding since 2017, we would have expected the yield curve to steepen. The Fed has little control over long rates; the inversion is the result of market forces. That suggests the market expects a meaningful economic slowdown, and that the loose money on offer won’t be enough to prevent it. The term spread has turned (slightly) positive in recent weeks. This may mean that the risk of an economic slowdown has reduced, but it still needs to be taken into account.

Portfolio positioning

Monetary conditions today are certainly less restrictive compared to preceding inversions; and market volatility is now back to very low levels, with positive short-term indicators. Even so, significant structural risks to equity markets remain, such as the high level of corporate (and other) debt and a retreat from globalisation. In addition, some key equity markets have become overvalued.

The possibility of further upside versus the downside risk appears to be balanced for the time being. However, it’s a precarious balance; we could easily see either further surges or a significant market correction.

While risk-seeking investors may be willing to assume higher levels of risk in the current environment, an underweight risk position for risk-averse investors is also reasonable. As for the default “Balanced” investor, a neutral risk position seems to be about right.

Disclaimer