What Investors Can Do About it Today

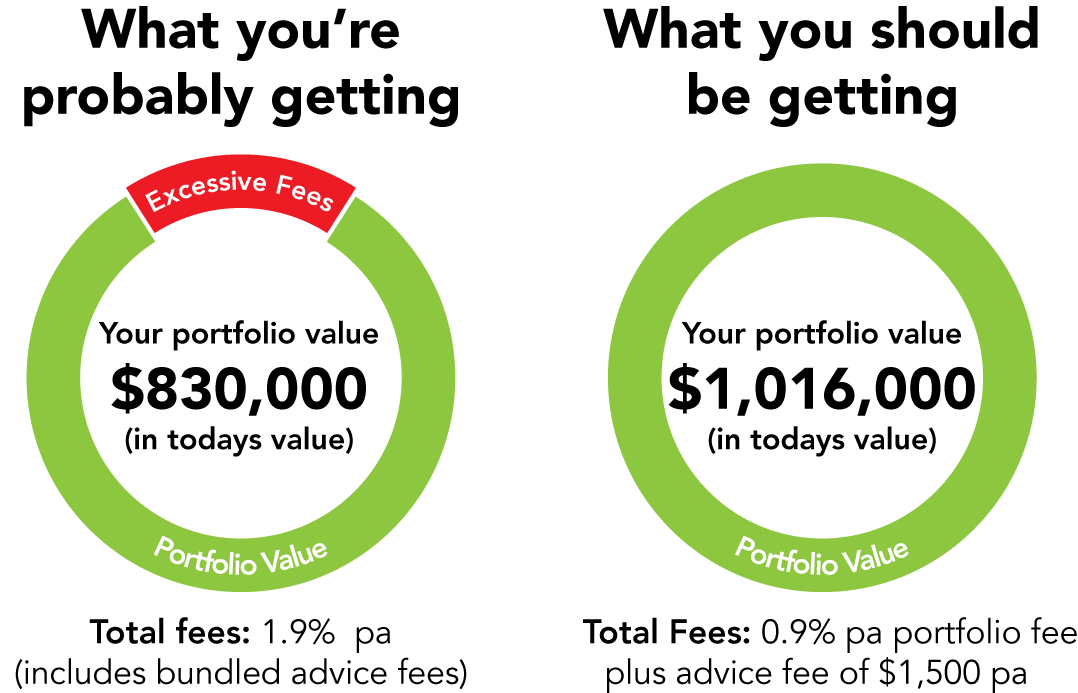

In simple terms, the Royal Commission is all about protecting your wealth by reducing excessive fees that you’re likely paying under a conflicted advice model. A fee reduction of just 1%pa can increase your nest-egg value by up to $186,000 over 25 years, in today’s value based on a $500,000 portfolio earning 6.5% pa.

The Royal Commission in a Nutshell

From the perspective of financial advice, the Royal Commission’s focus on fee transparency is all about putting client interests first. This has far reaching consequences within the advice industry and is forcing the vast majority of financial advisors to re-think their existing business model. While the recommendations of The Royal Commission may not be known until 2019, there are several steps investors can take today to demand higher levels of transparency and accountability. The obvious first step is to separate planning advice from portfolio advice.

This is not a time to sit on your hands and wait.

The Hidden Cost of Bundled Fees

To illustrate the cost of bundled fees, a saving of 1% pa in fees can increase your portfolio by up to $186,000 in today’s value. Illustration based on a $500,000 portfolio earning 6.5% pa over 25 years. So, while the monthly fees charged to your account may not look very big, they can have a sizeable impact on the value of your retirement nest-egg over your working life.

How Does Unbundling Put Client Interests First?

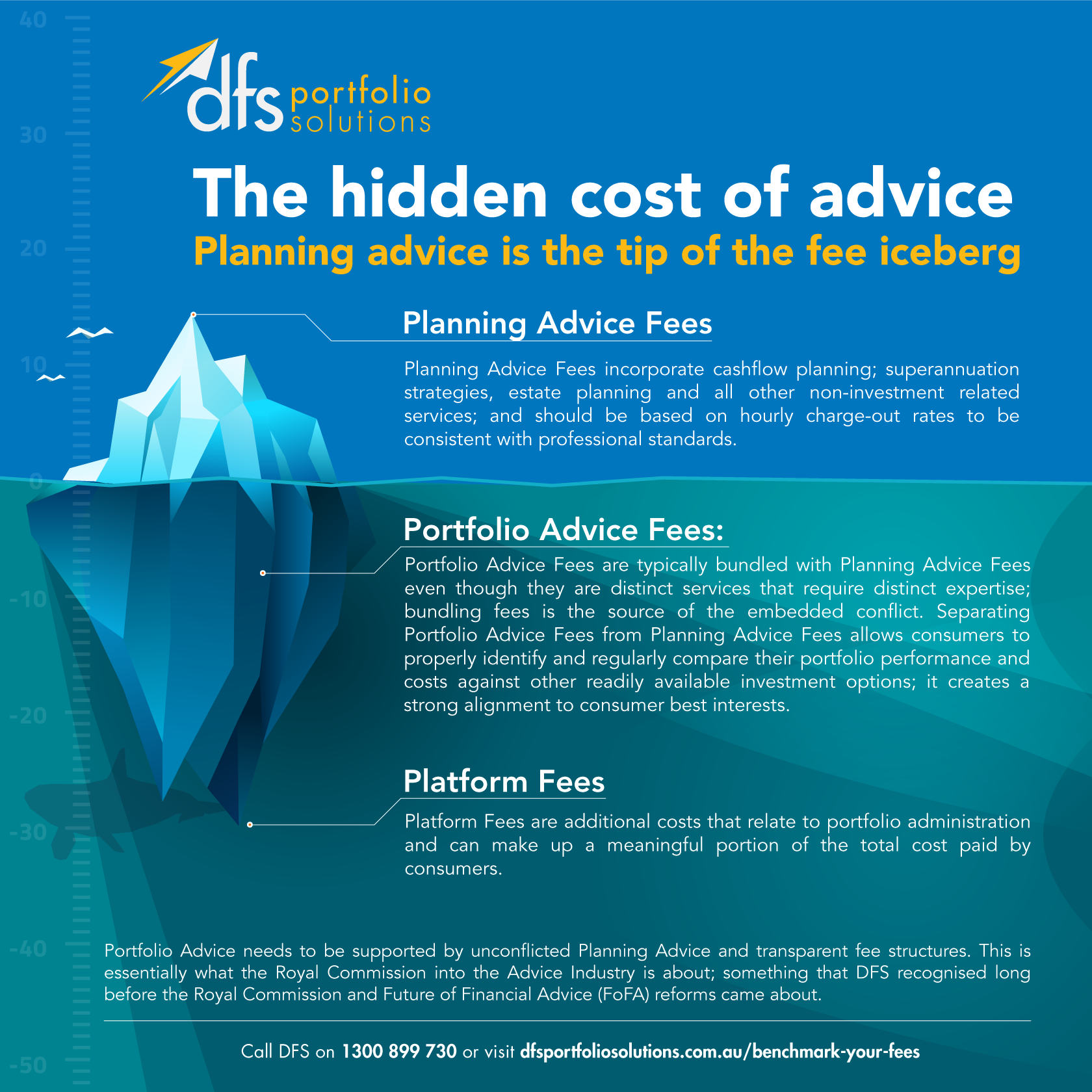

Receiving advice from a financial advisor generally involves several parties who all take a cut along the way. As a result, it’s hard for investors to measure value-for-money due to a lack of transparency. For instance, a typical fee structure includes:

- platform fees;

- fund manager fees; and

- planning and portfolio advice fees.

Although the Future of Financial Advice (FOFA) reforms prevent advisors from receiving benefits from product providers, advisors can still bundle portfolio advice with planning advice. This discourages advisors from comparing their portfolios against other readily available investment options; it impedes you from ascertaining whether your advisor is delivering genuine value or depleting it.

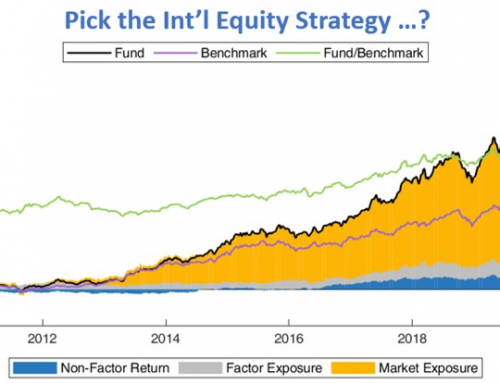

When planning advice is unbundled from portfolio advice, investors can compare the performance of their portfolio against recognised industry benchmarks. It provides you with evidence to assess the quality of the advice you receive on an apples-to-apples basis. It further provides the means for advisors to demonstrate that they are acting in your best interests. Separating planning advice from portfolio advice makes a lot of sense for all parties.

Three Steps to Benchmark Your Fees

To determine the quality of your advice, you need evidence that demonstrates that your best interests are being met. You can determine this by seeking answers to the following three questions:

- What fees are you paying?

- What is the performance of your portfolio?

- Are you getting value for money?

Although these are very simple questions, the answers may not be readily available. The reason is that the bundled fee structure inhibits your advisor from ascertaining the true cost of your portfolio and measuring its true performance.

What You Can Do Today

To make evidence-based investment decisions, it’s important to look for advisors who offer unbundled portfolio services. Separating planning advice from portfolio advice is the only way investors can benchmark their fees and portfolio performance.

Rather than wait for the industry to change in response to the Royal Commission’s recommendations, you can respond today.

With close to a 10 year track record of separating planning advice from portfolio advice, DFS can help you better understand how your current advice arrangements are affecting you.

A Complimentary Fee Appraisal is available to you, or alternately you can attend one of our events where we will present on how you can assess and benchmark your own fees.

For a Complimentary Fee Appraisal or to attend an event in your city, call 1300 899 730 to find out more.

DFS Portfolio Solutions

Accountability through Transparency™

Disclaimer