DFS Portfolio Solutions (DFSPS) takes a risk based approach to asset allocation, as we believe it produces better portfolio outcomes compared to conventional portfolio management. DFSPS comprehensively measures and reviews the portfolio risk with the objective of managing the risk levels to specified targets. When material changes in market risks are observed, we stabilise the portfolio risk by changing the asset allocation. In contrast, conventional portfolio management allows risk to fluctuate, as it keeps the asset allocation (more or less) constant.

Current Portfolio Risk

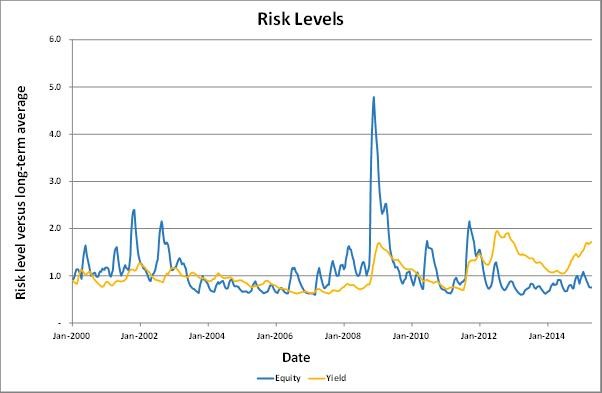

The charts below plot the two main portfolio risk factors. It plots the risk levels of equities and bond yields and compares them with their average long term levels. We observe that equity risk has generally been muted in recent years and is now around 25% under its average level. Consequently, our exposure to growth assets continues to be meaningfully overweight. In contrast (bond) yield risk has been elevated under an environment of strong yield contraction. Yield risk has increased markedly since 2014 and is now some 70% above its average level. Exposure to bonds (yield risk) continues to be at minimum permitted levels.

Equity risk

Equity risk demands an additional layer of risk management as it is the dominant risk factor within all portfolios; it accounts for more than 50% of the risk (even) within Conservative portfolios. Whilst we closely monitor equity risk and adjust portfolios accordingly, the risk signals alone cannot predict the magnitude of oncoming corrections. We respond to an elevated risk of such a shock occurring by stopping out from equity assets in favour of cash. This additional downside risk management strategy is generally employed during periods where equity market valuations are stretched and price support has broken down. Equity market overvaluation is our first criteria, as this factor is the major cause of long term portfolio impairment. By definition, the extent to which equity markets can fall is limited when valuations are cheap (or inexpensive); and recovery is typically fairly rapid under such market conditions.

A common requirement for equity markets to rally into overvalued territory appears to be a consensus view that “things are different this time”. Since the early 1990s, there have been two standout periods. The Tech-bubble’s promise of a new-age economy drove equities into the stratosphere by early 2000. Surprisingly, only a few years later (2003-2007), the rapid expansion in the securitisation of “diversified” US residential mortgages persuaded markets that risk was being efficiently transferred to institutions that were able to properly price and manage it. This belief also drove markets into broad based overvaluation. Ultimately, both periods resulted in significant losses across all major equity markets, as highlighted in the chart below.

Currently, the requisite consensus view of “things are different” appears to be missing. If anything, ‘things this time’ are unfavourably different, which is consistent with the restrained CAPE valuations of all equity markets, with the exception of US equities. The CAPE chart (below) shows US equities approaching pre-GFC valuation levels and its decoupling from the other equity markets. Interestingly, approximately 1/3rd of the US equity reflation since 2009 has been underpinned by earnings growth, with PE expansion being responsible for rest. The US Fed’s non-conventional monetary stimulus (QE) appears to explain much of the PE expansion as equity yields became increasingly attractive against extremely low bond yields. US (and indeed global) inflationary pressures have also remained subdued, which have further conspired to keep bond yields low. Unsurprisingly, we observe that our appointed international equity managers have, on aggregate rotated away from US equities in search for better value as reflected in the chart below.

Equity Risk – DFSPS Position

US 10 Year bond yields have increased by 0.33% to 2.23% over the last month and the question on everyone’s’ mind is whether this is the start of the normalisation in bond yields. If so, global equity markets would be adversely impacted, however the US equity market would be falling from the highest rung. In such circumstances, DFSPS is poised to stop-out from US equities but would maintain allocations to the other growth assets which remain undervalued or at fair value.

DFSPS continues to monitor market risk and equity valuation levels and make proactive adjustments to keep portfolios more stable. Our risk based approach suits investors that prefer to increase wealth in positive increments rather than accepting significant portfolio fluctuations associated with traditional portfolio management.