The Credit and Commodity super cycles have rewarded Australian investors with abnormal returns over the last 15 years. In hindsight, there was little need to diversify your portfolio over this time. However, the case for robust risk management is now a reality. Yields on defensive assets are at historically low levels and return expectations on Growth assets are subdued. Geopolitical risks are elevated; the plight to re-inflate developed economies continues and China’s effort to transition its economy adds further risk to the global outlook. The ‘easy-money’ is probably behind us and portfolios are likely to face an environment of lower returns and higher volatility. This is the time for greater portfolio resilience!

An insight to SMSF portfolio performance

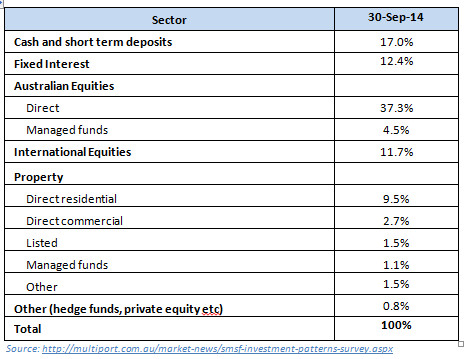

The current volatile market conditions appear to be testing the resilience of investment portfolios, with many being caught off-guard by the sudden sell-off in equity and commodity markets. The table below shows the aggregated asset allocation of Self-Managed Super Funds as at 30 September 2014, based on a sample of over 2,500 SMSFs administered by Multiport.

- Around 30% is invested in defensive assets and 70% to growth assets, which is indicative of an asset allocation that lies between Balanced and Growth oriented portfolios

- A vast majority of the Australian equity exposure is through direct shares, most of which are in the “Top 20”

- There is a low proportion invested in international equities

- There are very low allocations to hedge funds and private equity investments

- Allocations to Direct residential property is becoming more common

Common sense reasoning: SMSF members have probably applied the following rationale to derive and justify the above asset allocation:

- Growth assets are favoured as yields on Defensive assets have been reducing steadily and are now at historically low levels

- The dividend yield on Australian equities continues to be compelling against Defensive assets and particularly so with franking credits

- Australian equities have generally outperformed international equities over the last 15 years and most of the returns have consistently come from the Top20 stocks

- Direct equity ownership is easily achieved without any imposition of investment management fees

- International equities are perceived as being higher risk (with much lower dividends) and are not readily accessible

- The higher costs associated with international equity investing is a deterrent to many

- Hedge funds are not easily understood and they generally charge high fees

- Residential property is seen as a low risk/high return investment, supported by its strong historical performance (since 1997)

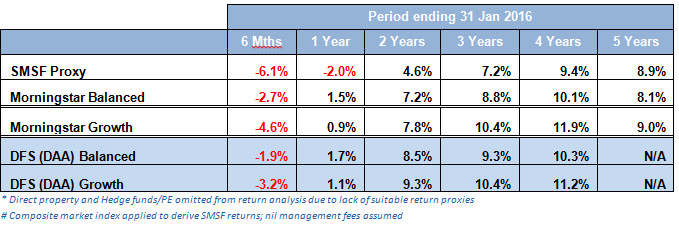

Track record: we have assessed the performance of the above asset allocation (using appropriate market based proxies for each investment component) against the Morningstar Balanced and Growth indices over the last 5 years. The results are presented in the table below*:

We note the following:

- The SMSF asset allocation performed well between 2011 and 2014, but has been deficient thereafter

- There is a clear deteriorating performance trend against the market benchmark

- Inadequate diversification is the primary reason for the performance deterioration

- The solid longer term performance of SMSFs was underpinned by Large-Cap Australian shares, which generated over 16%p.a. for the 3 years ending December 2014

- SMSFs have been adversely impacted by the performance of Large-Cap Australian shares over the last 12 months

- With the exception of the 5 year return, SMSF returns have generally lagged the Morningstar Indices

- Future performance substantially depends on Large Cap Australian equities and general buoyancy across risk assets

DFSPS applies the following to better diversify portfolios:

Risk-based asset allocation: our Models dynamically re-balance between growth and defensive assets as market risk levels bounce up and down. When market conditions are volatile, portfolios are tilted to defensive assets; when we observe stable market conditions, they tilt to growth assets to take advantage of the strong returns being generated. This is in contrast to relative valuation approaches, which seek to forecast and rotate to asset classes that ‘promise’ better returns. We note that our Risk Profile Models significantly reduced risk over 2015.

Investment selection: is based on a strong fundamental approach, which seeks to maximise investment opportunities and reduce risk. Considerations around tax optimisation and beneficial ownership must be and are always secondary to investment fundamentals.

- Active versus Passive: both active and passive managers are used extensively. When market conditions are stable, portfolios are tilted to Passive investments as active managers are generally unable to outperform, net of fees. Under such conditions, investors are rewarded with efficient and highly cost effective access to market exposures. When conditions become volatile, portfolios are tilted to Defensive assets by divesting from the Passively managed Growth investments. Whereas passive Growth investments are exposed to greater downside risk under volatile conditions, active management is expected to provide meaningful out-performance, net of fees.

- Australian Large Cap Model: is one our active asset class models made up of high quality fund managers. Pleasingly, our appointed managers have largely avoided banks and resource companies and allocated to market segments that offer better risk adjusted opportunities. The Large Cap Model has out-performed the S&P/ASX300 by 13.9% and 8.1%p.a. over the last 12 months and 2 years, respectively.

- Alternative Investment Strategies: is another actively managed model, which aims to generate positive returns across all markets conditions. It aims to do so by investing in liquid strategies that are not exposed to traditional market risk factors. The Model is designed to be a strong diversifier and is part of the Defensive asset allocation. The Model has out-performed its cash benchmark by 1.2% and 3.7%p.a. over the last 12 months and 2 years, respectively.

- International exposures: provide additional diversification benefits that are otherwise unavailable through the domestic equity market. The depreciation of the AUD has also benefited all unhedged international exposures, which includes Equites, Infrastructure securities and Real Estate Investment Trusts.

The DFSPS Portfolios continue to perform well against the Morningstar Risk Profile Indices and other comparative benchmarks. A strong focus on risk management through legitimate portfolio diversification is the key reason.